“Unlock Your Financial Potential with First Midwest Bank Loan: Empowering individuals and businesses to achieve their dreams, our trusted institution offers flexible and competitive loan options. Say yes to financial success – whether you’re aiming for personal milestones or expanding your business horizons, First Midwest Bank is here to support your journey towards prosperity.”

First Midwest Bank Loan: Low Fixed APR and Fast Decisions

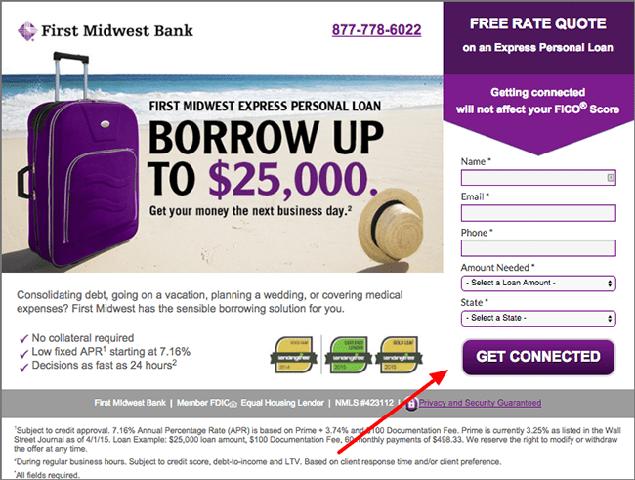

When it comes to borrowing money, finding a loan with a low fixed Annual Percentage Rate (APR) is crucial. At First Midwest Bank, we offer loans with a starting APR as low as 6.26%. This means that you can borrow money at a competitive interest rate, saving you money in the long run.

Not only do we offer low fixed APRs, but we also pride ourselves on making fast decisions. With our streamlined application process, you can receive a decision on your loan application in as little as 24 hours. This means that you don’t have to wait around for weeks to find out if you’re approved or not.

Consolidating Debt or Improving Your Home? We’ve Got You Covered

If you’re looking to consolidate your debt or make improvements to your home, First Midwest Bank has the sensible borrowing solution for you. Our personal loans can be used for a variety of purposes, including debt consolidation and home renovations.

By consolidating your debt with a personal loan from First Midwest Bank, you can simplify your finances and potentially save money on interest payments. Plus, our low fixed APR ensures that your monthly payments will remain consistent throughout the life of the loan.

If you’re planning on making improvements to your home, our personal loans can provide you with the funds you need. Whether it’s a kitchen remodel or a new roof, our competitive interest rates and fast decisions mean that you can start your project sooner rather than later.

- Low fixed APR starting at 6.26%

- Fast decisions in as little as 24 hours

- Funds available the next business day

- Flexible repayment terms

- Consolidate debt and save money on interest

- Fund home improvements and renovations

When it comes to borrowing money, trust First Midwest Bank to provide you with a low fixed APR and fast decisions. Contact one of our Personal Loan Experts today to get started on your borrowing journey.

Consolidate Debt or Improve Your Home with a First Midwest Bank Loan

Are you struggling with multiple debts and looking for a way to simplify your financial situation? Or perhaps you have been dreaming of renovating your home but don’t have the funds to do so. Look no further than First Midwest Bank, where we offer low fixed APR starting at 6.26% to help you consolidate debt or improve your home.

Why Choose First Midwest Bank?

- Low Fixed APR: Our competitive interest rates ensure that you can borrow money without worrying about skyrocketing interest charges. With a fixed APR starting at 6.26%, you can plan your repayments with confidence.

- Fast Decisions: We understand that time is of the essence when it comes to financial matters. That’s why we strive to provide decisions as fast as 24 hours, so you can get the funds you need without unnecessary delays.

- Quick Disbursement: Once your loan is approved, you won’t have to wait long to access the funds. With our next business day disbursement policy, you can start consolidating debt or improving your home sooner than you think.

Note: Consolidating debt refers to combining multiple debts into one loan, often resulting in a lower overall interest rate and simplified repayment terms. Improving your home may include renovations, repairs, or additions that enhance its value and comfort.

If you’re ready to take control of your finances or turn your house into the home of your dreams, our Personal Loan Experts are here to guide you through the process. At First Midwest Bank, we prioritize privacy and security, ensuring that your personal information is protected throughout the loan application and approval process.

Don’t let debt or home improvement dreams hold you back. Connect with a Personal Loan Expert at First Midwest Bank today and discover the sensible borrowing solution that suits your needs.

Get Your Money Fast with First Midwest Bank’s Quick Loan Process

When you need funds quickly, First Midwest Bank offers a quick loan process to ensure you get your money as soon as possible. With decisions made as fast as 24 hours, you can have the peace of mind knowing that your financial needs will be met in a timely manner. Whether you’re consolidating debt or improving your home, First Midwest Bank has the sensible borrowing solution for you.

Low fixed APR starting at 6.26%

One of the advantages of choosing First Midwest Bank for your personal loan is the low fixed APR starting at 6.26%. This means that you can borrow money at a competitive interest rate, allowing you to save on interest charges over time. With a low fixed APR, you can confidently plan your budget and repay your loan without worrying about fluctuating interest rates.

- Flexible repayment terms

- In addition to offering a low fixed APR, First Midwest Bank also provides flexible repayment terms. This means that you can choose a repayment schedule that works best for your financial situation. Whether you prefer shorter-term loans with higher monthly payments or longer-term loans with lower monthly payments, First Midwest Bank can accommodate your needs.

- No collateral required

- Another benefit of First Midwest Bank’s quick loan process is that no collateral is required. This means that you don’t have to put up any assets, such as your home or car, as security for the loan. Instead, your eligibility for the loan will be based on factors such as your credit history and income.

With First Midwest Bank’s quick loan process, privacy and security are guaranteed. As a member of FDIC and an equal housing lender, First Midwest Bank prioritizes the protection of your personal information. You can have peace of mind knowing that your financial details are safe and secure.

When you’re in need of funds for debt consolidation or home improvement, trust First Midwest Bank to provide a sensible borrowing solution. With a quick loan process, low fixed APR, flexible repayment terms, and no collateral required, you can get your money fast and start working towards your financial goals.

Sensible Borrowing Solutions from First Midwest Bank

Are you looking for a low fixed APR and fast decision on your loan application? Look no further than First Midwest Bank. With our competitive rates starting at 6.26% APR, you can consolidate your debt or make improvements to your home without breaking the bank.

At First Midwest Bank, we understand that time is of the essence when it comes to borrowing money. That’s why we strive to provide decisions as fast as 24 hours. We know that waiting for loan approval can be stressful, so we work efficiently to ensure you receive a prompt response.

Consolidating Debt or Improving Your Home?

If you’re burdened with multiple debts and high interest rates, our low fixed APR personal loans can help you simplify your finances and potentially save money on interest payments. By consolidating your debt into one manageable loan, you can reduce stress and focus on paying off what you owe.

Alternatively, if you’re looking to make improvements to your home, such as renovating your kitchen or adding an extension, our sensible borrowing solutions can provide the funds you need. With flexible repayment terms and competitive rates, our personal loans are designed to suit your individual needs.

- Low fixed APR starting at 6.26%

- Decisions in as fast as 24 hours

- Funds available the next business day

When it comes to borrowing money, trust First Midwest Bank to provide a secure and reliable solution. As a member of the FDIC and an equal housing lender, we prioritize privacy and security for all our customers. You can rest assured knowing that your personal information is protected.

Contact us today to speak with a Personal Loan Expert who can guide you through the borrowing process. Whether you’re consolidating debt or improving your home, First Midwest Bank is here to help.

First Midwest Bank Personal Loans: Trustworthy and Secure

At First Midwest Bank, we understand the importance of providing trustworthy and secure personal loan options for our customers. With a low fixed APR starting at 6.26%, we offer competitive rates that make borrowing affordable and manageable.

Our streamlined application process allows for quick decisions, with approval as fast as 24 hours. This means you can receive the funds you need to consolidate debt or improve your home in a timely manner. And with next business day funding, you won’t have to wait long to access your money.

When it comes to consolidating debt, our personal loans can help simplify your finances by combining multiple payments into one. This not only makes it easier to manage your monthly budget, but it can also potentially save you money on interest charges.

If you’re looking to make improvements to your home, our personal loans provide a sensible borrowing solution. Whether you want to renovate your kitchen, add an extra bedroom, or upgrade your landscaping, our flexible loan terms and competitive rates can help make your vision a reality.

First Midwest Bank is committed to ensuring the privacy and security of our customers’ information. We guarantee that any personal data shared during the loan application process will be protected according to industry standards. You can trust that your information is safe with us.

Our team of Personal Loan Experts is ready to assist you throughout the entire loan process. They are knowledgeable about our products and services and can answer any questions or concerns you may have. We strive to provide exceptional customer service and ensure that you have a positive borrowing experience with us.

As a member of the FDIC and an equal housing lender, First Midwest Bank adheres to strict regulations and guidelines to protect consumers’ rights. Our NMLS #423112 accreditation further demonstrates our commitment to transparency and accountability in the lending industry.

In conclusion, if you’re in need of a trustworthy and secure personal loan, look no further than First Midwest Bank. With competitive rates, fast decisions, and next business day funding, we provide the sensible borrowing solution you’re looking for. Trust in our expertise and experience to help you achieve your financial goals.

Expert Guidance for Your Financial Needs at First Midwest Bank

At First Midwest Bank, we understand that managing your finances can be overwhelming. That’s why we offer expert guidance to help you navigate through your financial needs. Whether you’re looking to consolidate debt or make improvements to your home, our low fixed APR starting at 6.26% can provide you with the sensible borrowing solution you need.

Consolidating Debt

If you find yourself drowning in multiple debts with high interest rates, consolidating your debt can be a smart move. By taking out a personal loan with First Midwest Bank, you can pay off all your existing debts and have only one manageable monthly payment. Our low fixed APR ensures that you’ll save money on interest payments compared to high-interest credit cards or other loans.

Home Improvements

Is your home in need of repairs or upgrades? A personal loan from First Midwest Bank can provide the funds necessary for your home improvement projects. Whether it’s renovating your kitchen, adding an extra bedroom, or installing energy-efficient appliances, our fast decision-making process and quick funding ensure that you can start improving your home as soon as possible.

With decisions as fast as 24 hours and the ability to receive your money the next business day, First Midwest Bank prioritizes efficiency and convenience for our customers. Our team of Personal Loan Experts is ready to assist you every step of the way, ensuring that you have all the information and support needed to make informed financial decisions.

When choosing First Midwest Bank for your borrowing needs, rest assured that privacy and security are guaranteed. As a member of the FDIC and an equal housing lender, we adhere to strict regulations to protect our customers’ personal information.

Don’t let financial stress hold you back from achieving your goals. Connect with a Personal Loan Expert at First Midwest Bank today and let us guide you towards a brighter financial future.

In conclusion, First Midwest Bank’s loan services offer a reliable and accessible solution for individuals and businesses in need of financial support. With competitive interest rates, flexible repayment options, and a streamlined application process, First Midwest Bank is committed to helping customers achieve their goals and navigate through their financial journey with confidence.